The employee must begin to use some. The employer may then take a credit against its wage obligation for the differenceup to 512 per hourin tips received by the employee if the cash wage plus the employees tips equal at least the minimum wage.

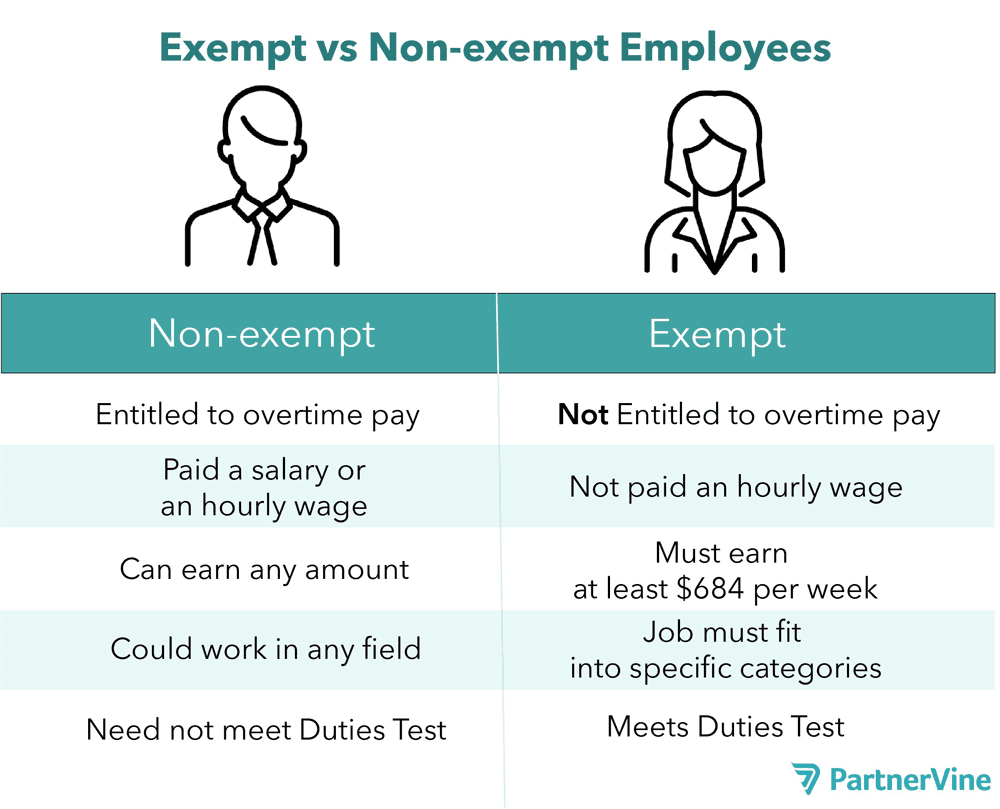

Overtime The Flsa And Exempt Vs Non Exempt Employees Partnervine

Some salaries are paid with federal funds tolls or fees.

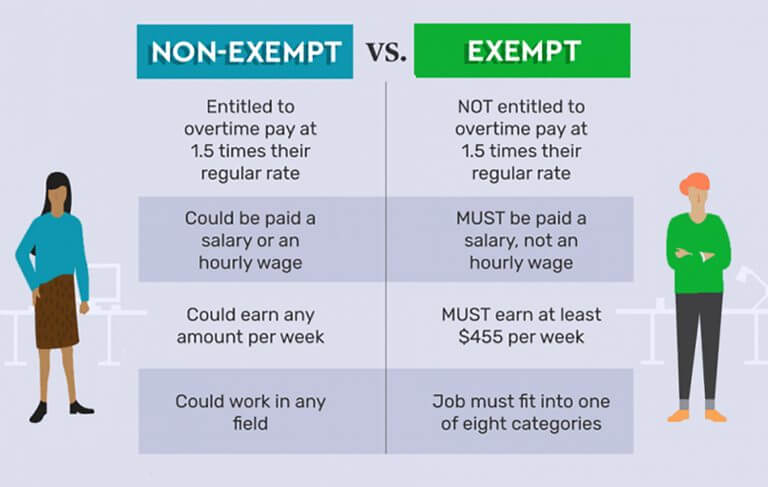

. For an exemption to apply an employees specific job duties and salary must meet all of the applicable requirements provided in the Departments regulations. Start Preamble Start Printed Page 51230 AGENCY. 12 hours in one workday.

Tipped employees who work overtime are to be paid one and one-half times the applicable minimum wage not one and one-half times 213 Youths and minimum wage. A minimum wage is the lowest remuneration that employers can legally pay their employeesthe price floor below which employees may not sell their labor. WAGE CLAIMS 2021 Studies show that as many as 4 out of 5 employees are the victims of wage theftIf your employer owes you money you have the right to immediately file a labor board complaint against your employer and have your case heard by a California Labor Commissioner-appointed judge.

Government report shows corporate America has used its. Not all salaries are funded by state tax dollars. The fact that a white-collar employee is paid on a salary basis does not alone provide sufficient ground to exempt that employee from the minimum wage and overtime requirements.

570 3170 60170 total pay due. Why wages are 20 lower than they should be. A salary is intended to cover straight-time pay for a predetermined number of hours worked during the workweek.

In 1938 the The Fair Labor Standards Act FLSA set the first US. 634 x 5 overtime hours 3170 total overtime premium pay. Overtime pay calculation for nonexempt employees earning a salary.

Wage and Hour Division Department of Labor. Youth employees under the age of 20 may be paid a minimum wage of no less than 425 an hour during the first 90 days of their employment. Overtime and tips.

Under Colorado state wage law employers are required to pay each non-exempt employee an overtime wage of one-and-a-half times the employees regular hourly rate for all hours worked in excess of. Call 213 992-3299 anytime. FSLA set the federal standard for protections on payment of minimum wage overtime pay employment of children and record-keeping.

Salary and wage amounts do not include other forms of compensation such as overtime. Because minimum wages increase the cost of labor companies often try to avoid minimum wage laws by using gig workers by. The Wage Act also requires that any employee discharged from employment shall be paid in full all wages earned up until the day of termination.

161 2 If an employee to whom subsection 1 applies has already worked the maximum hours of work prescribed under paragraph 91c the employer shall pay the employee for not less than three hours of work at one and one-half times the minimum wage rate or for the hours the employee works at the employees regular wage rate whichever is. The Department of Labor is updating and revising the regulations issued under the Fair Labor Standards Act implementing the exemptions from minimum wage and overtime pay requirements for executive administrative. If the employee does not earn sufficient tips to bring his or her hourly earnings to the minimum wage the employer must pay any.

Since the Wage Act defines wages as including paid vacation time employees must be compensated for earned and outstanding vacation time on the day of discharge. With inflation at a four-decade high a US. The employees overtime rate of pay if the.

Back then this new standard only represented about 20 of the labor force. This report provides information on the annual salaries or hourlydaily wages earned by employees. Note that the Colorado minimum wage for 2022 is 1256 per hour or 954 per hour for workers receiving enough in tips for their total pay to be at least minimum wage.

To begin use the search fields to generate a report. 40 hours in one workweek. COMPS Order 38 regularly refers to the PAY CALC Order and employers will begin seeing references to.

New York does not have any laws requiring an employer to pay an employee wages conceded to be due when involved in a wage dispute with the employee. The employer does not begin any action to pay an employee who has given consent for at least seven 7 business days. Employer costs per employee hour worked Supplemental pay includes employer costs for employee.

Shift differentials extra payments for working a non-traditional work schedule overtime and premium pay pay in addition to the regular work. Minimum wage at 025 per hour. Colorados overtime wage laws are more favorable to workers than federal law.

Most countries had introduced minimum wage legislation by the end of the 20th century.

Texas Unpaid Wages Overtime Lawyers Lemberg Law Llc

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

0 Comments